Read how to connect currency and enter exchange rates here.

1. First, we set up a cash on the go account.

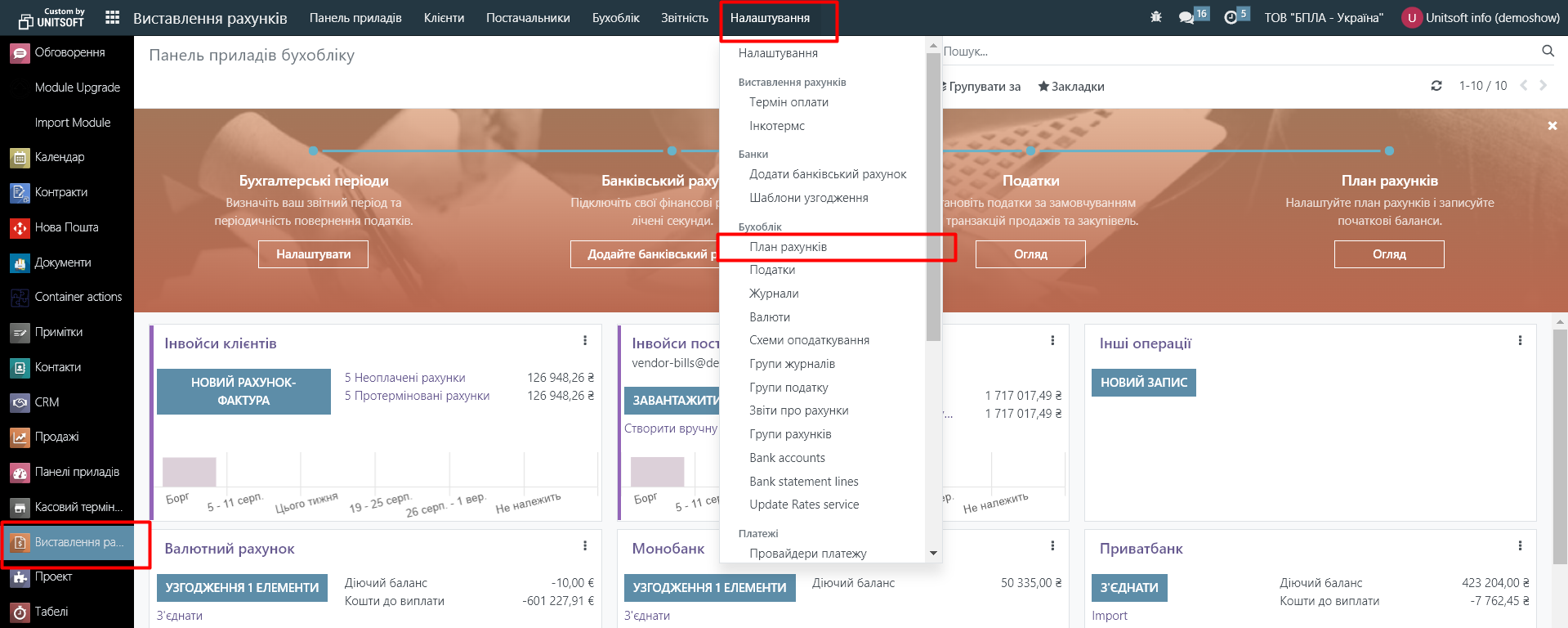

To do this, go to the "Invoicing" module - "Settings" - "Chart of Accounts":

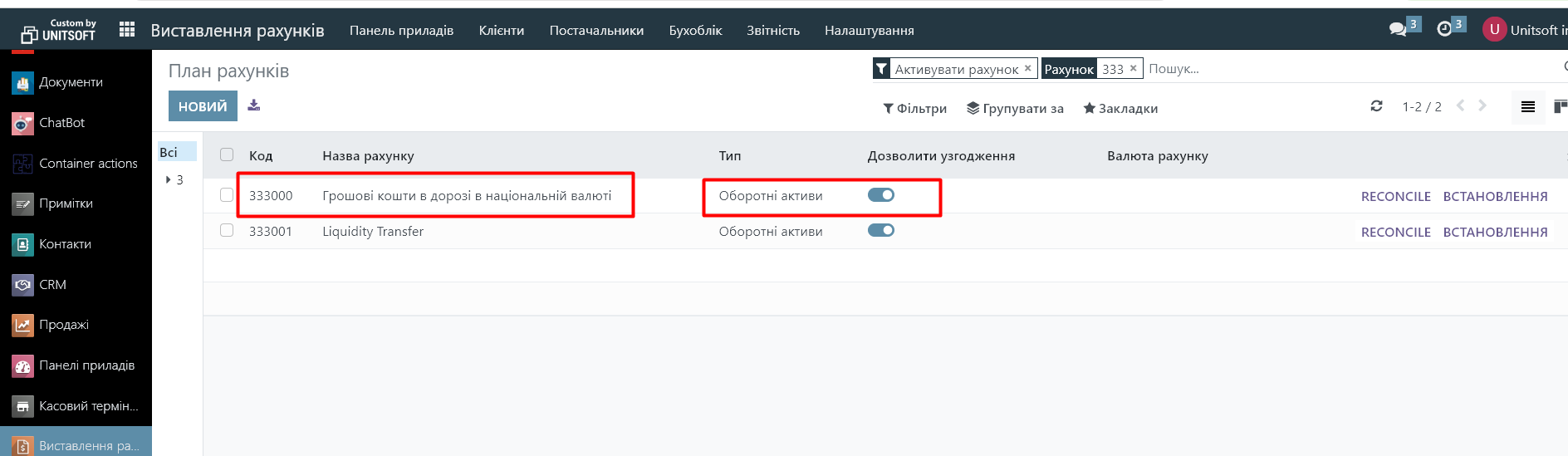

We look for account 333000 in the list. We change its type to "Current assets" and check "Allow reconciliation":

2. We create a debit from a bank account (we have 5000 UAH). Read more about how to create bank accounts and payments in the Odoo system here.

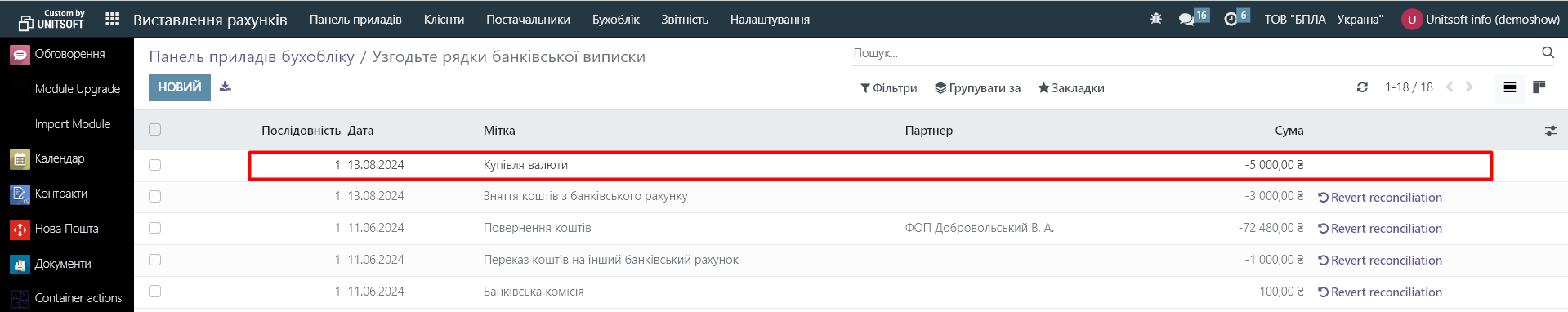

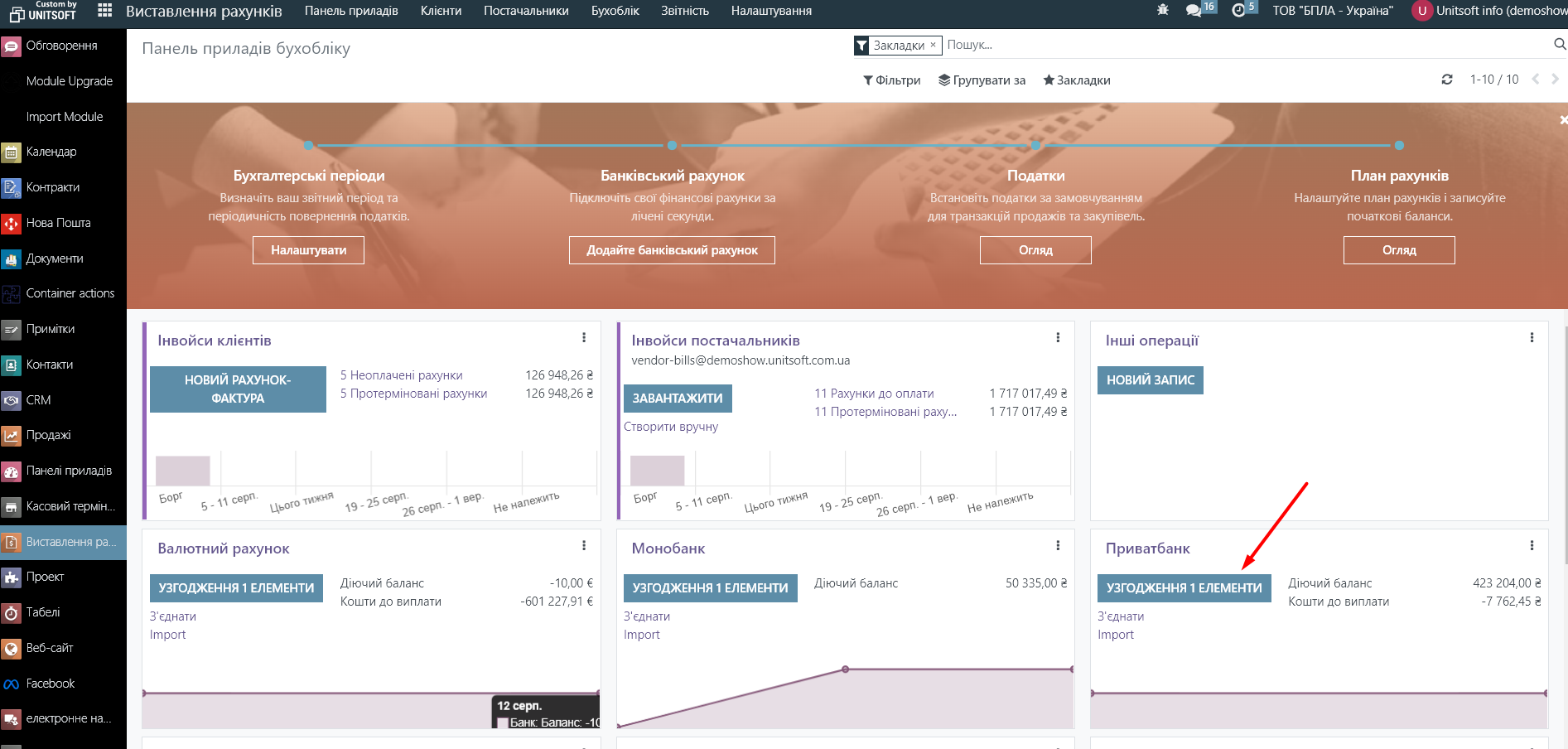

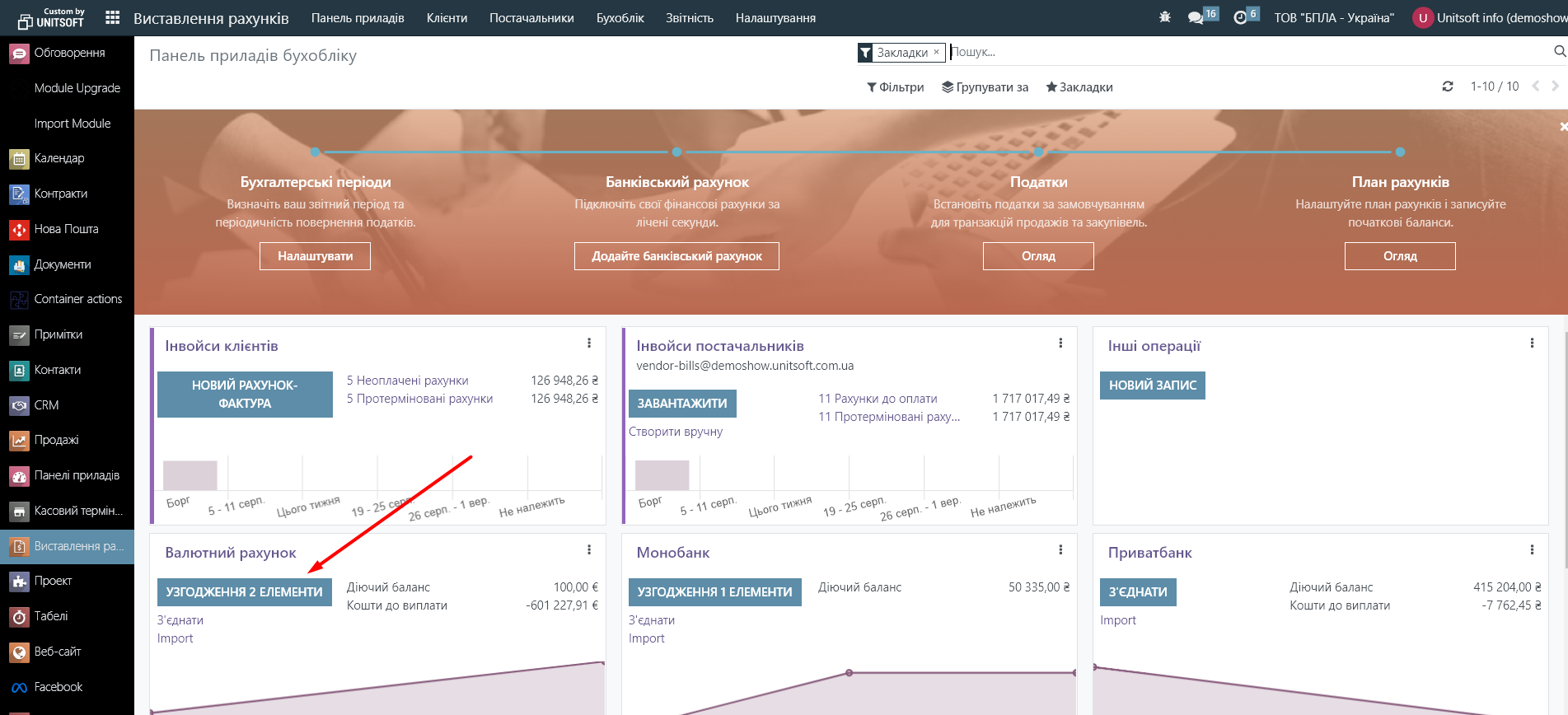

Click on the "Reconciliation" button in the corresponding bank account journal:

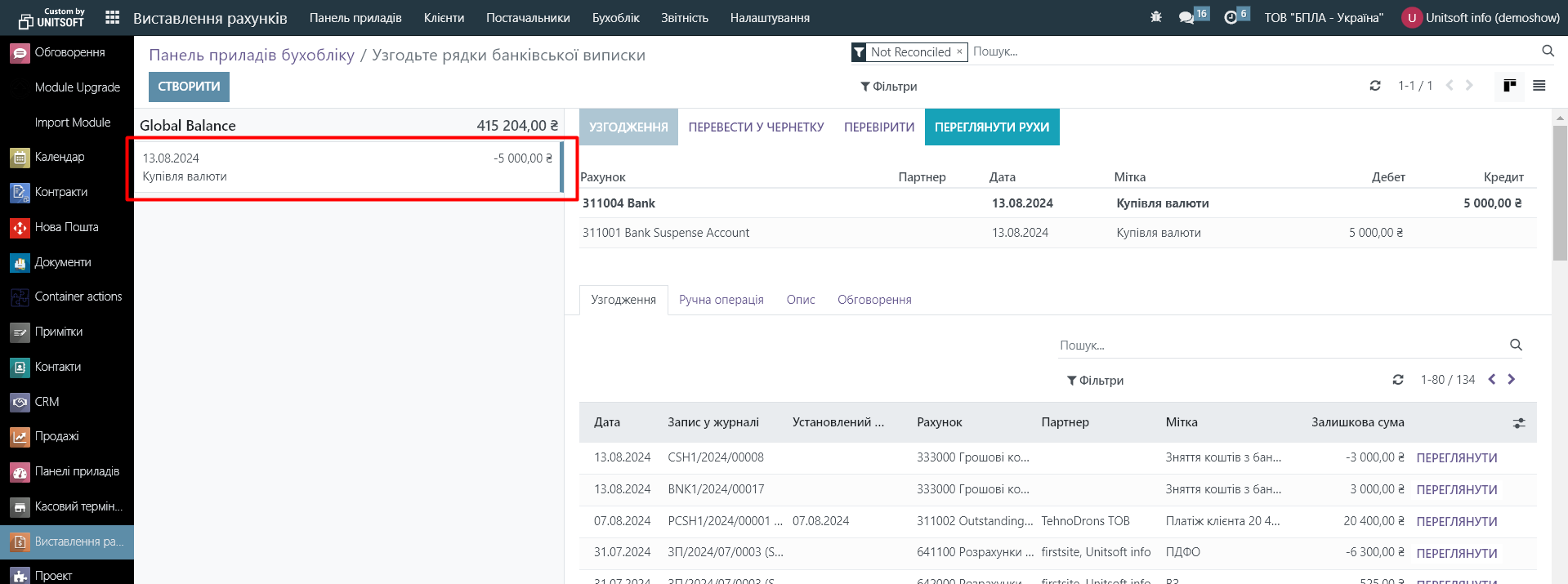

In the new window, click on the payment for which we plan to reconcile (to the created debit from the bank account):

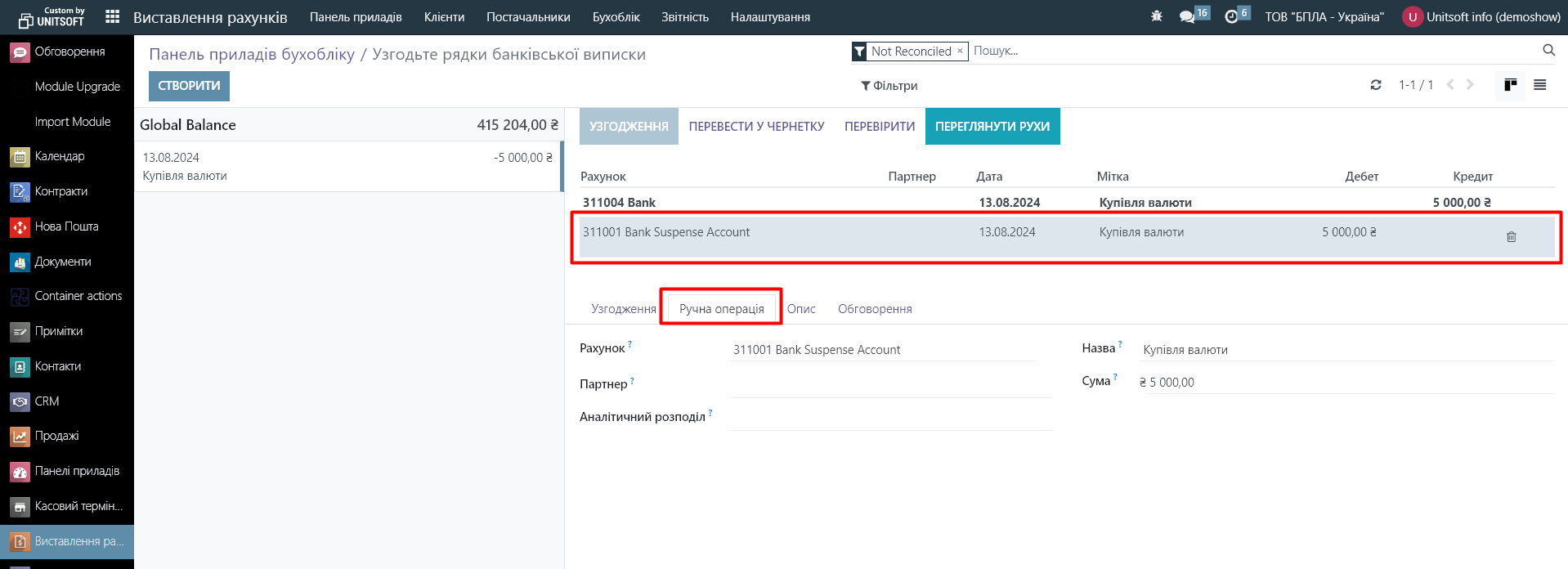

In the reconciliation window, click on the temporary correspondent account and go to the "Manual operation" tab:

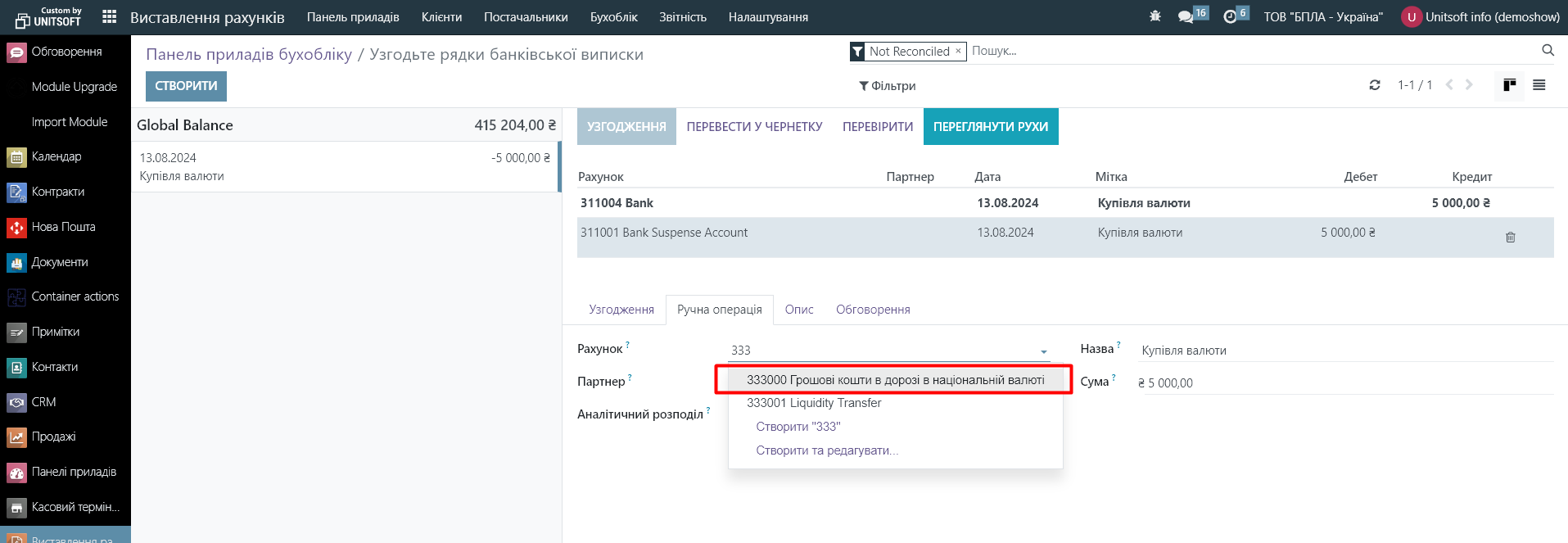

We change the existing account to the desired cash in transit account. In our case, it is 333000:

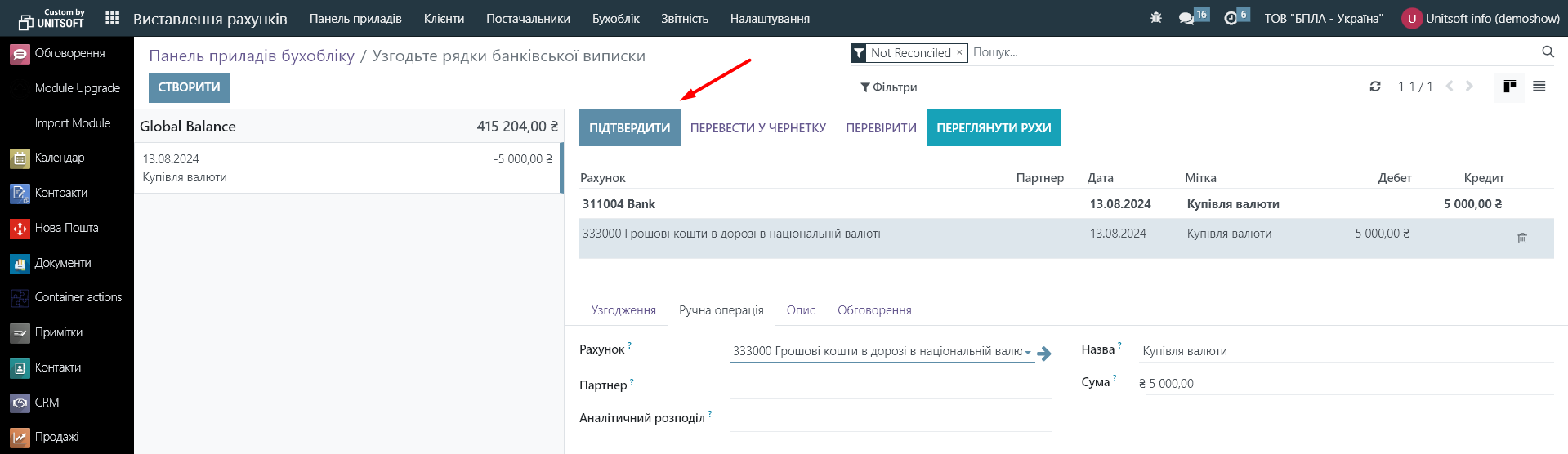

Click "Confirm":

3. We transfer funds to another bank account (we have 110 euros).

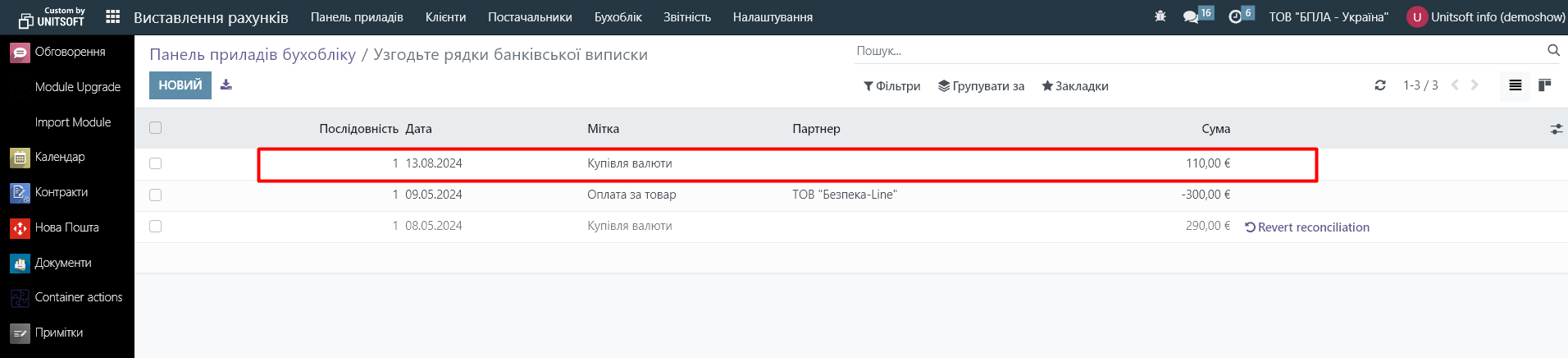

Click on the "Reconciliation" button in the corresponding bank account journal:

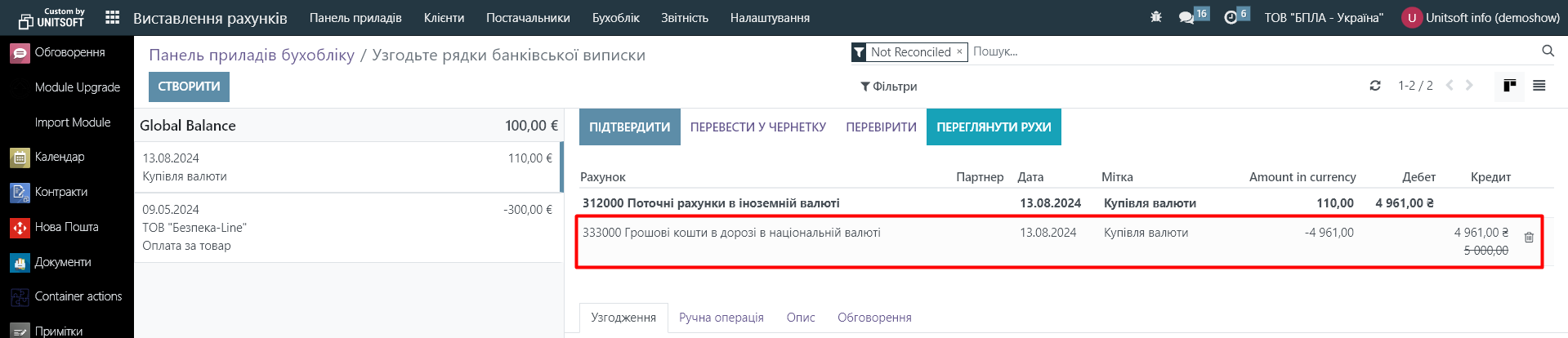

In the new window, click on the payment for which we plan to reconcile (for the created currency receipt):

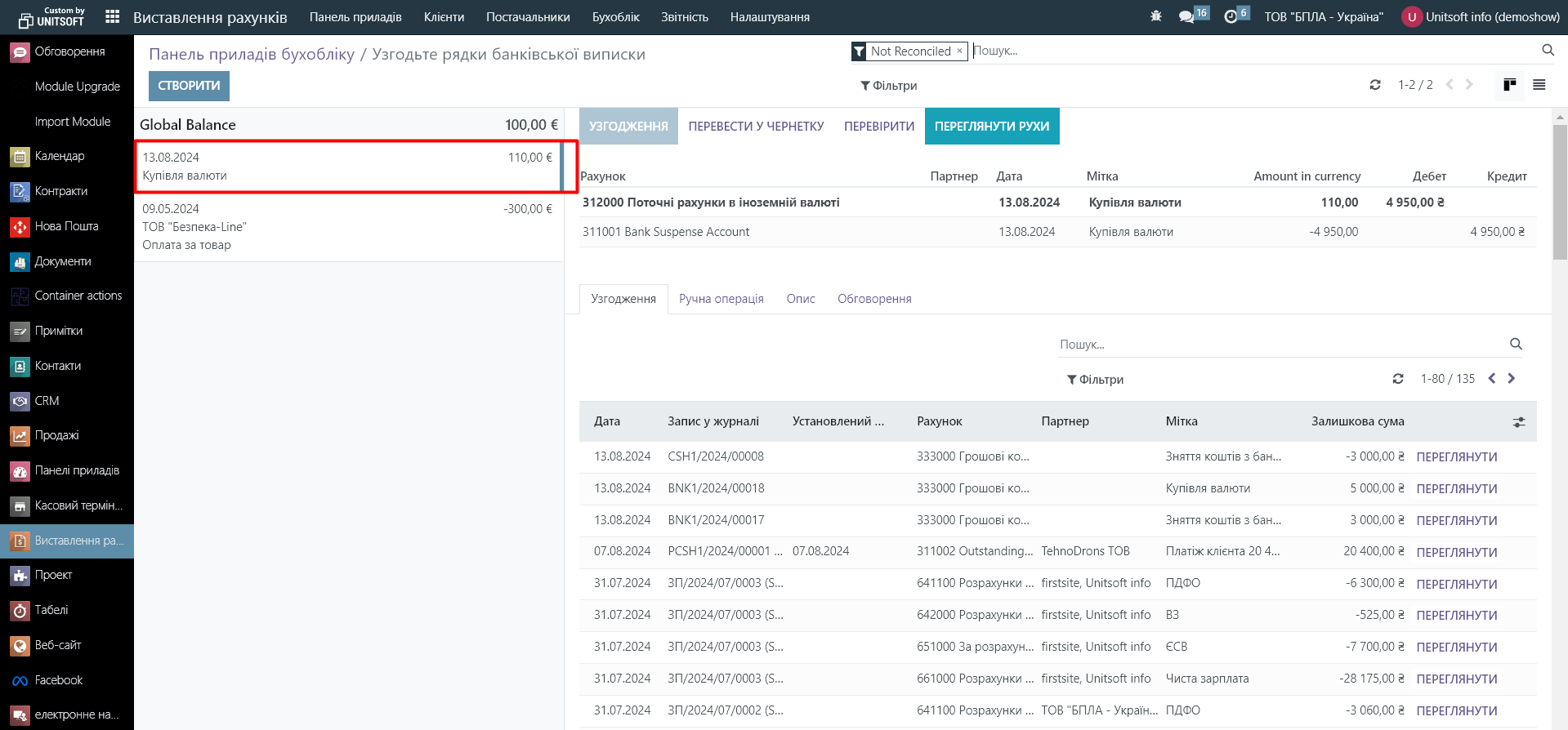

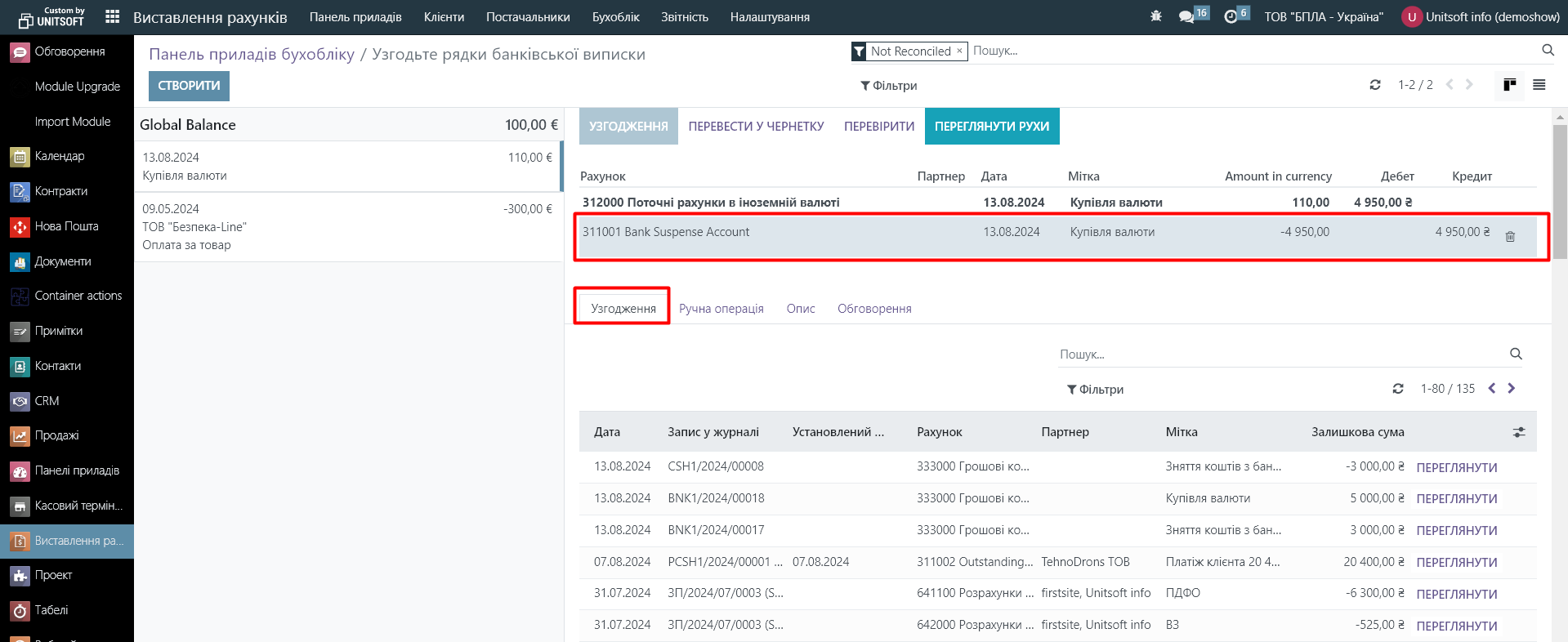

In the reconciliation window, click on the temporary correspondent account and go to the "Reconciliation" tab:

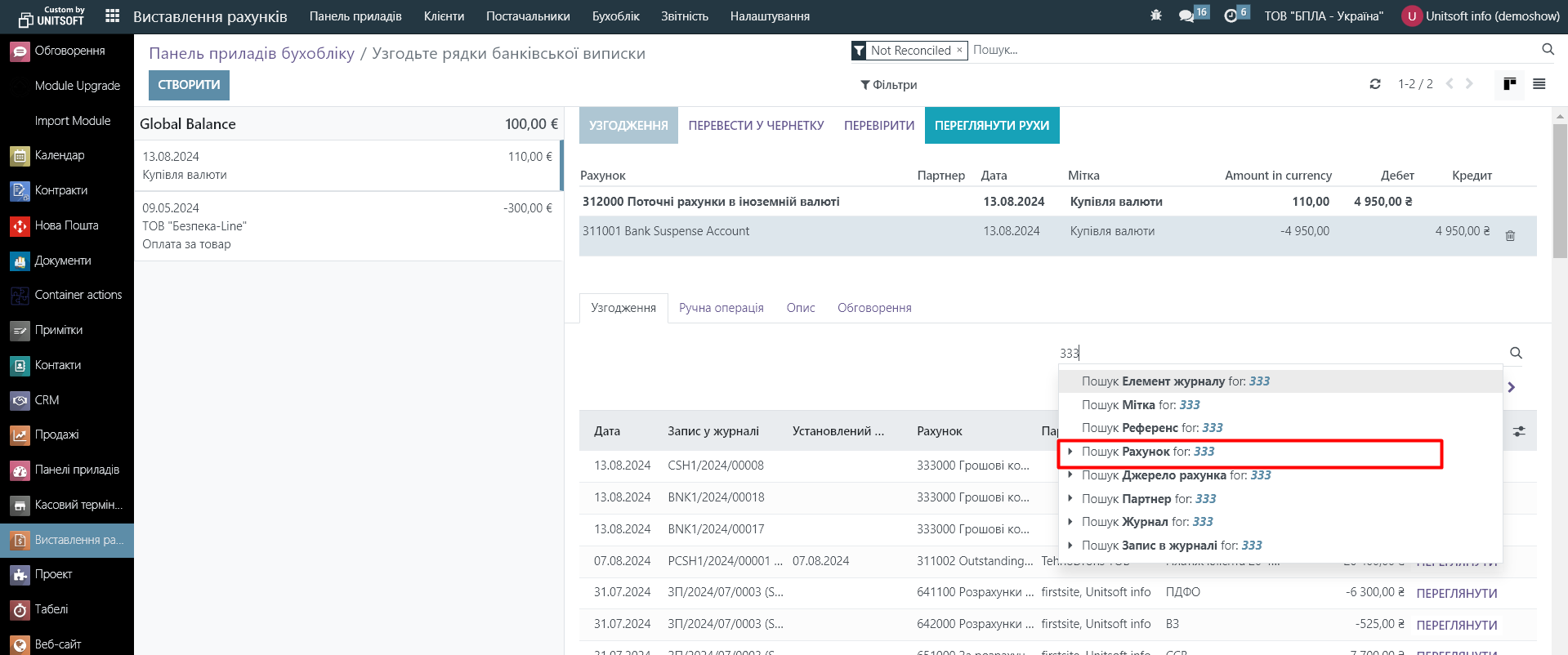

In the search bar, we look for entries with the account number 333000:

In the resulting list, select the record that was created when writing off hryvnia funds:

We click on it.

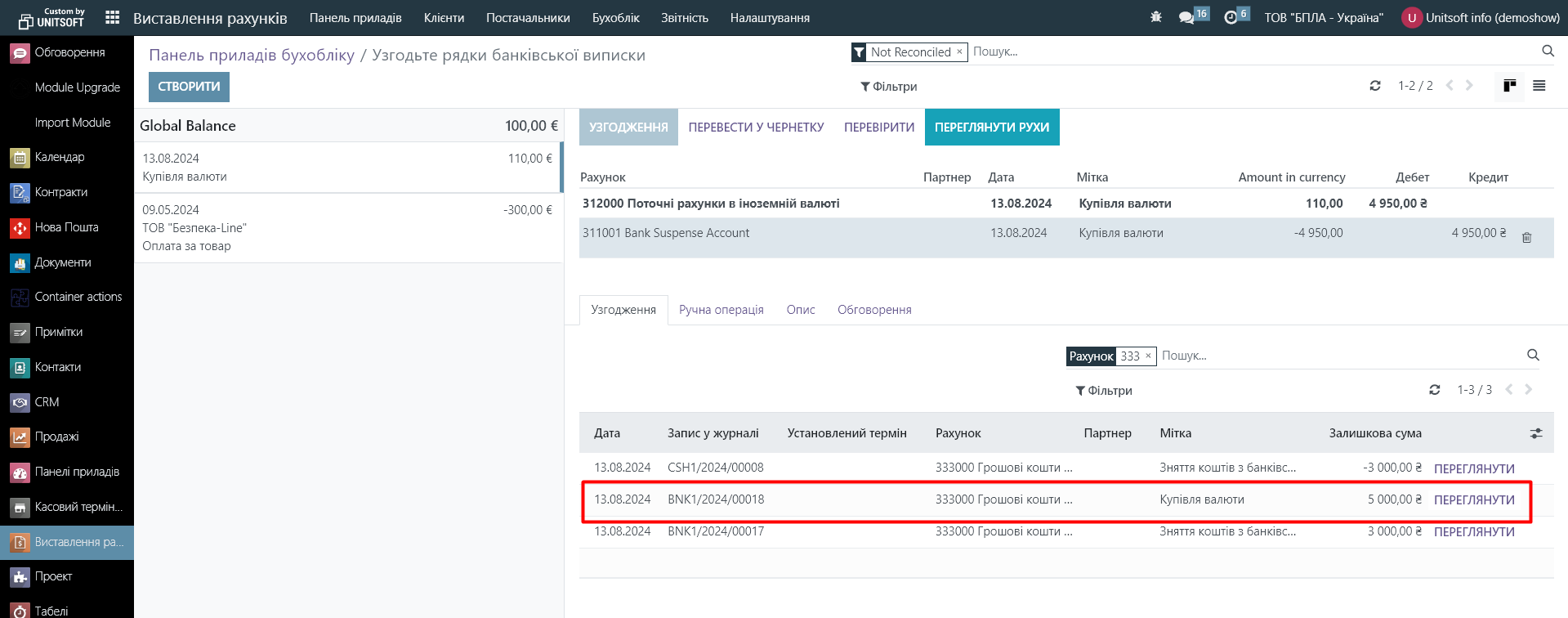

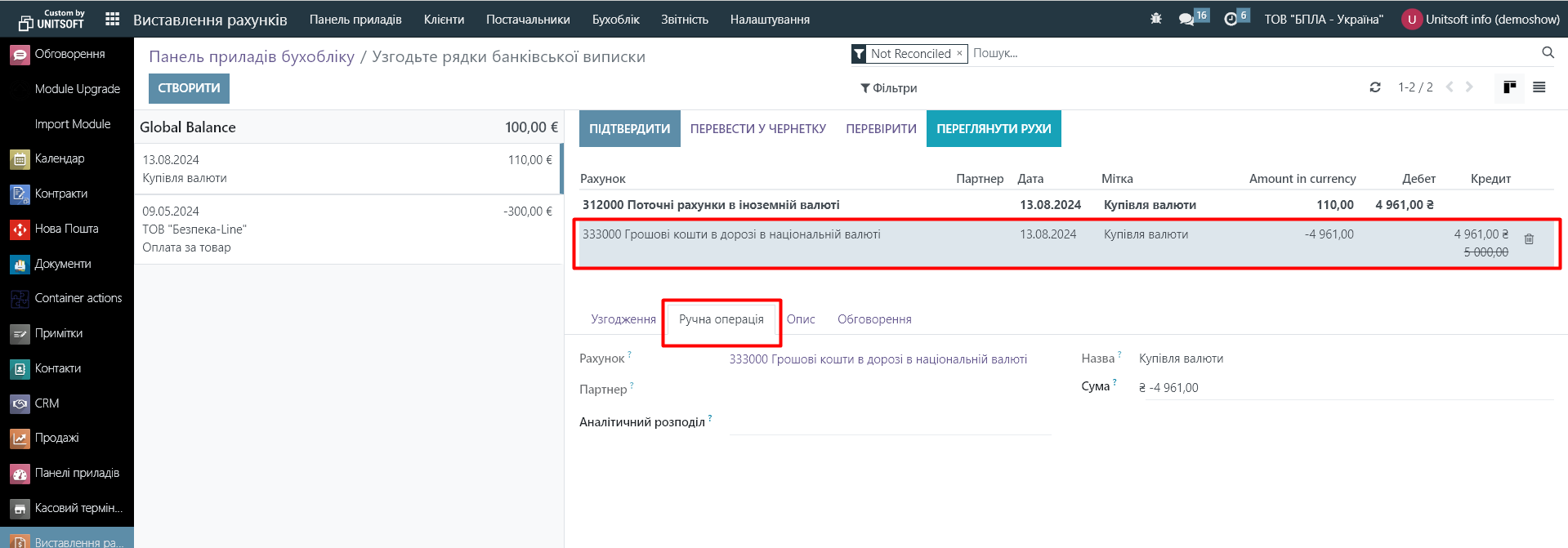

As you can see, the account in the reconciliation window has automatically changed from 311001 to 333000. And now we have reconciled only 110 euros (4961 UAH) with 5000 UAH written off. We still need to reflect the difference - 49 UAH (bank commission, exchange rate differences, etc.) and write it off as expenses:

To do this, click on the correspondent account again and go to the "Manual operation" tab:

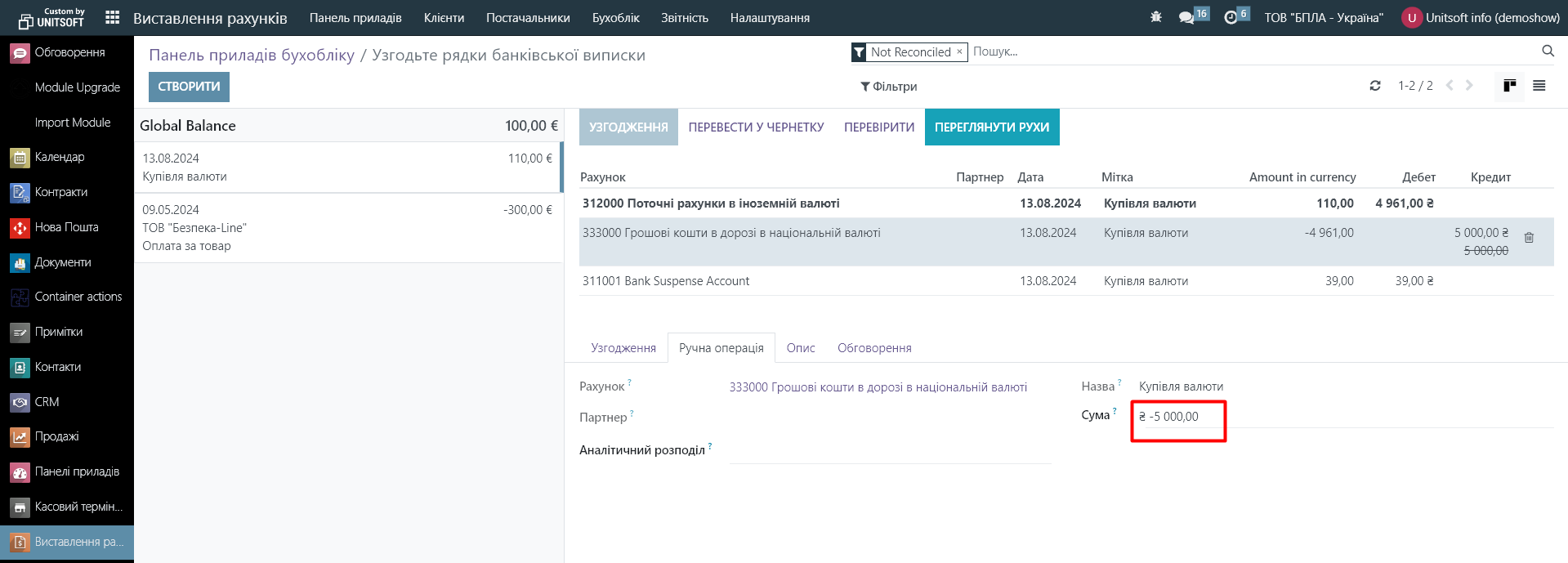

We change the amount to the full amount (-4961 UAH instead of -5000 UAH):

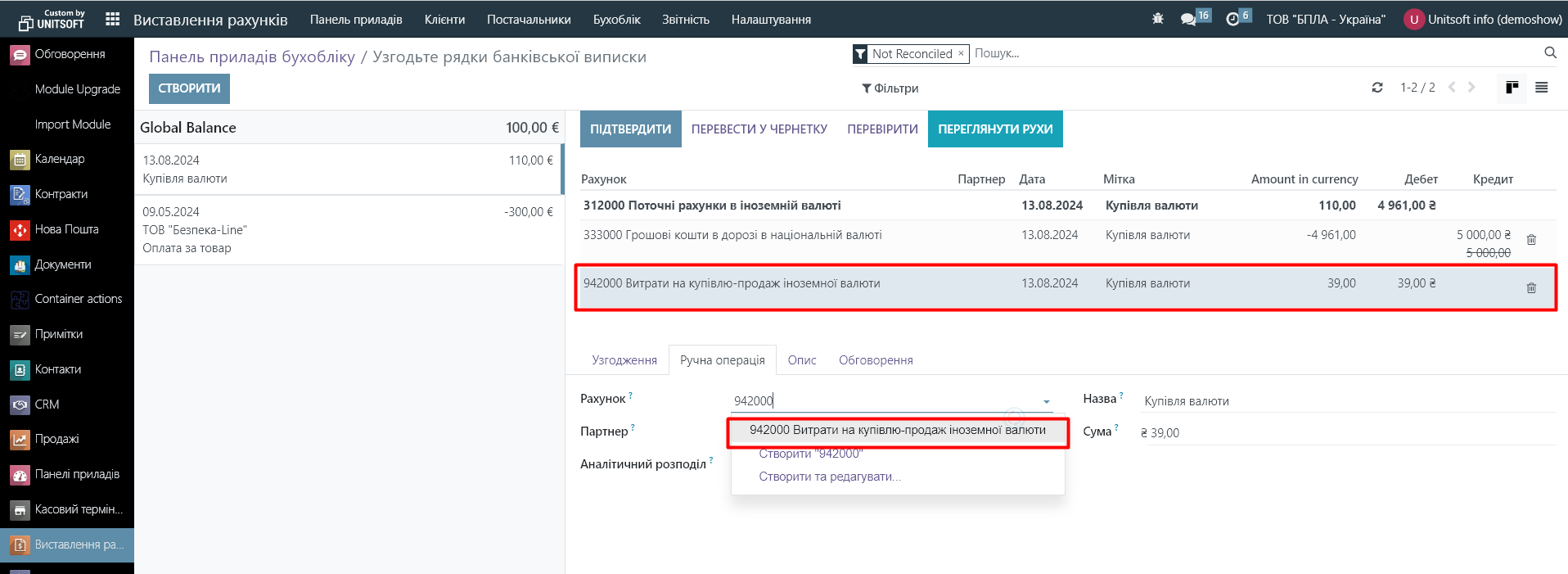

As a result, we will get an additional line for the difference. We specify which account this difference should be written off to. We click on the third line and specify the account (for example, 942000). If necessary, this amount can be divided and written off to different expense accounts.

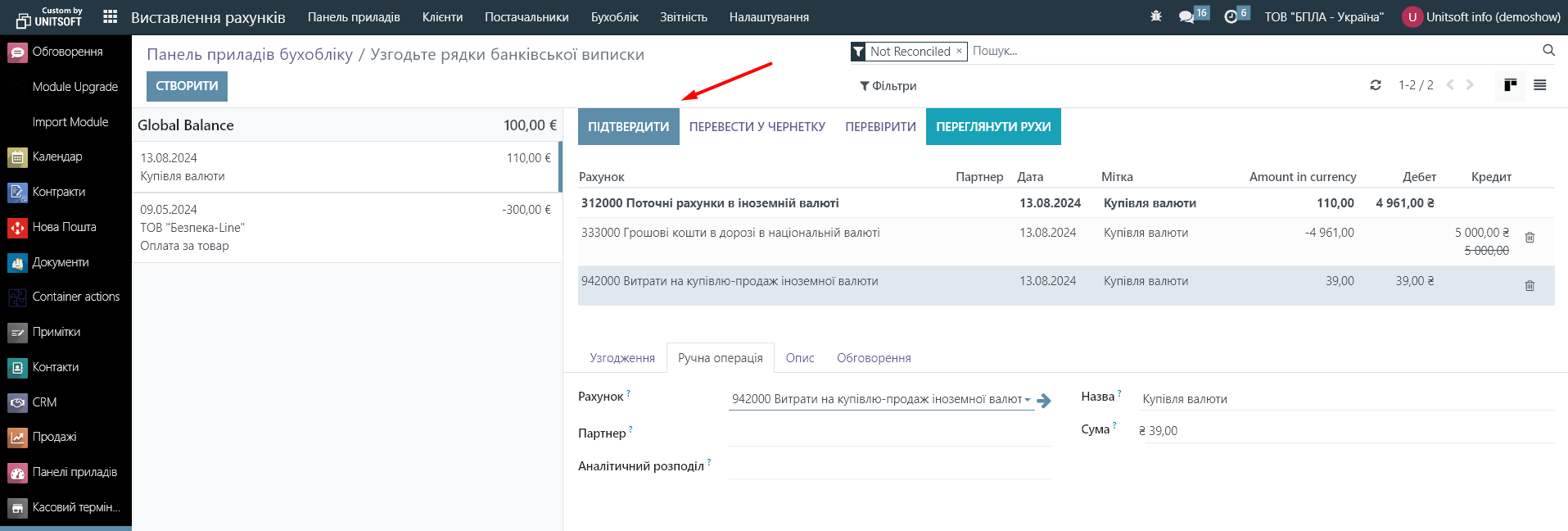

Click "Confirm":

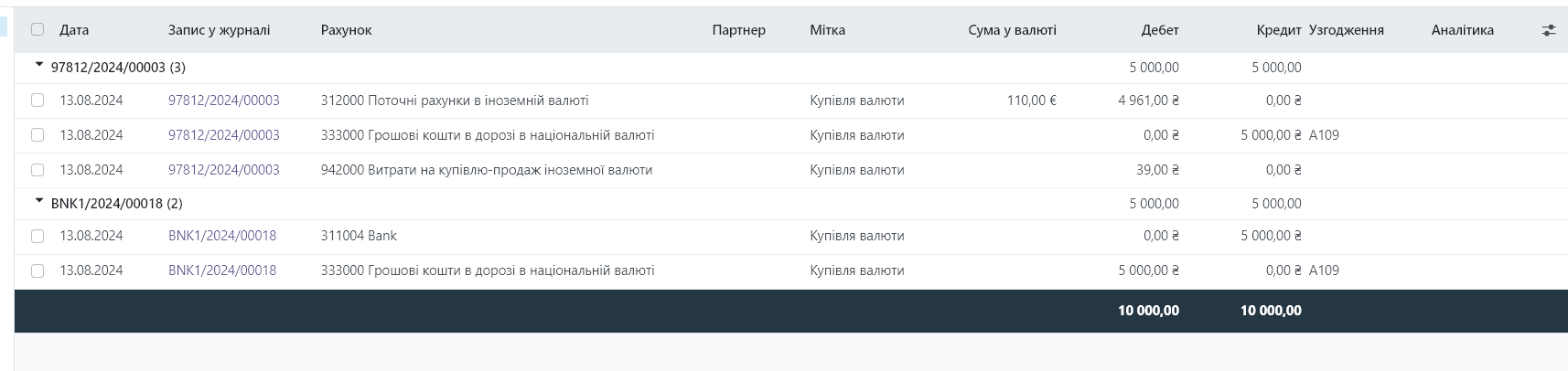

Received postings: