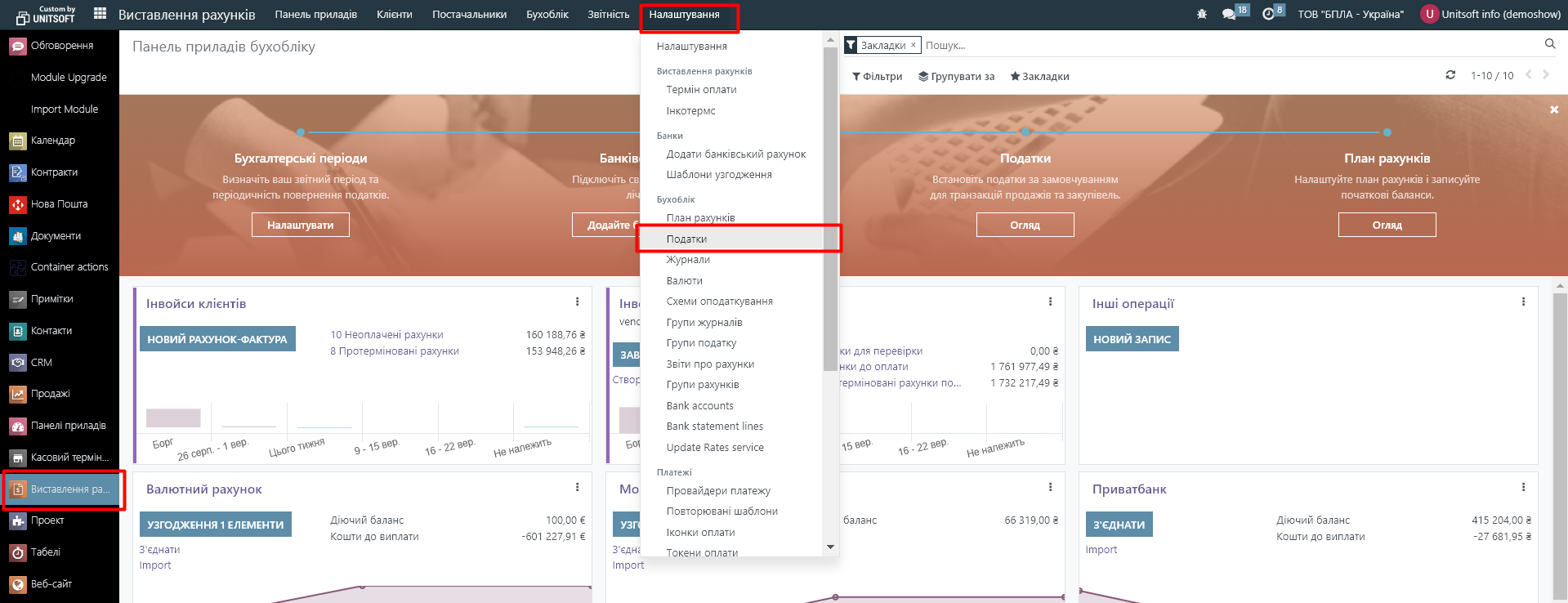

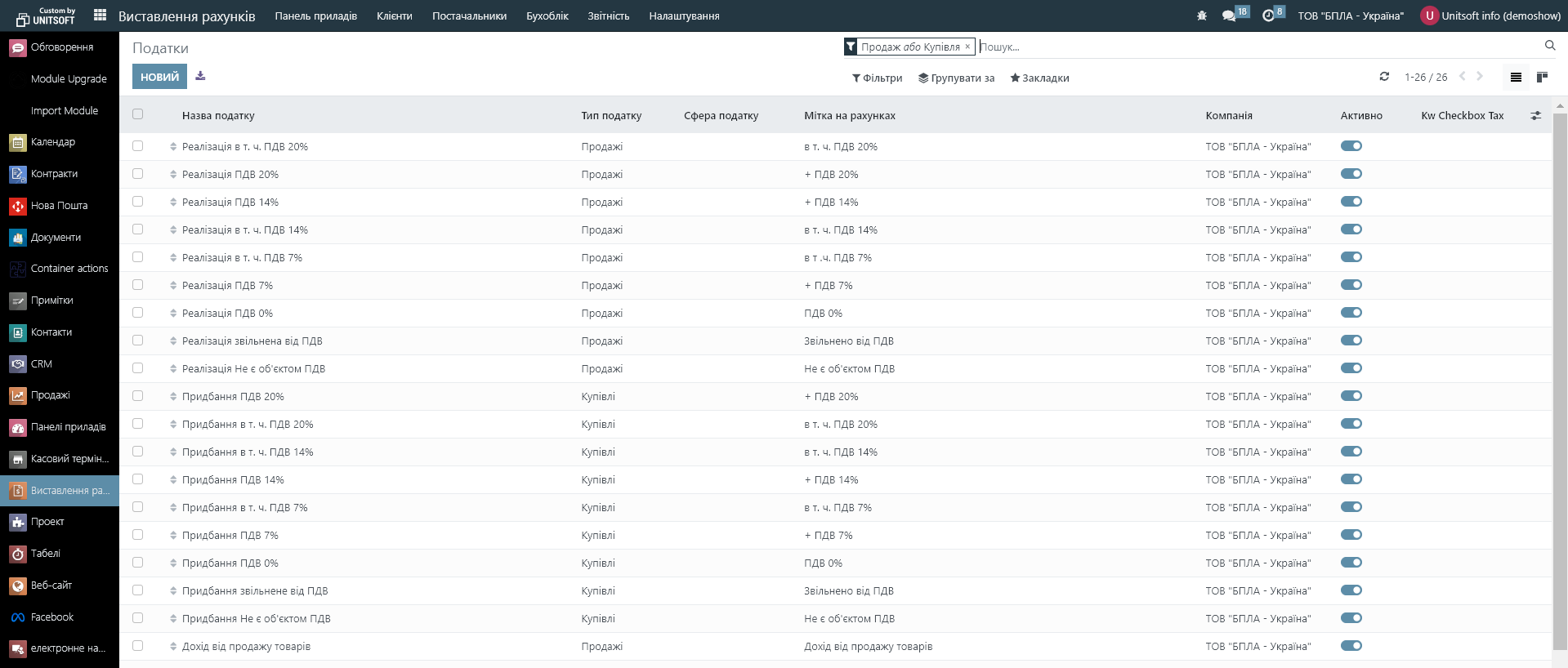

When installing Ukrainian localization, VAT rate settings were automatically created in your database. To view, change, or add them, you can go to the "Invoicing" - "Settings" - "Taxes" module:

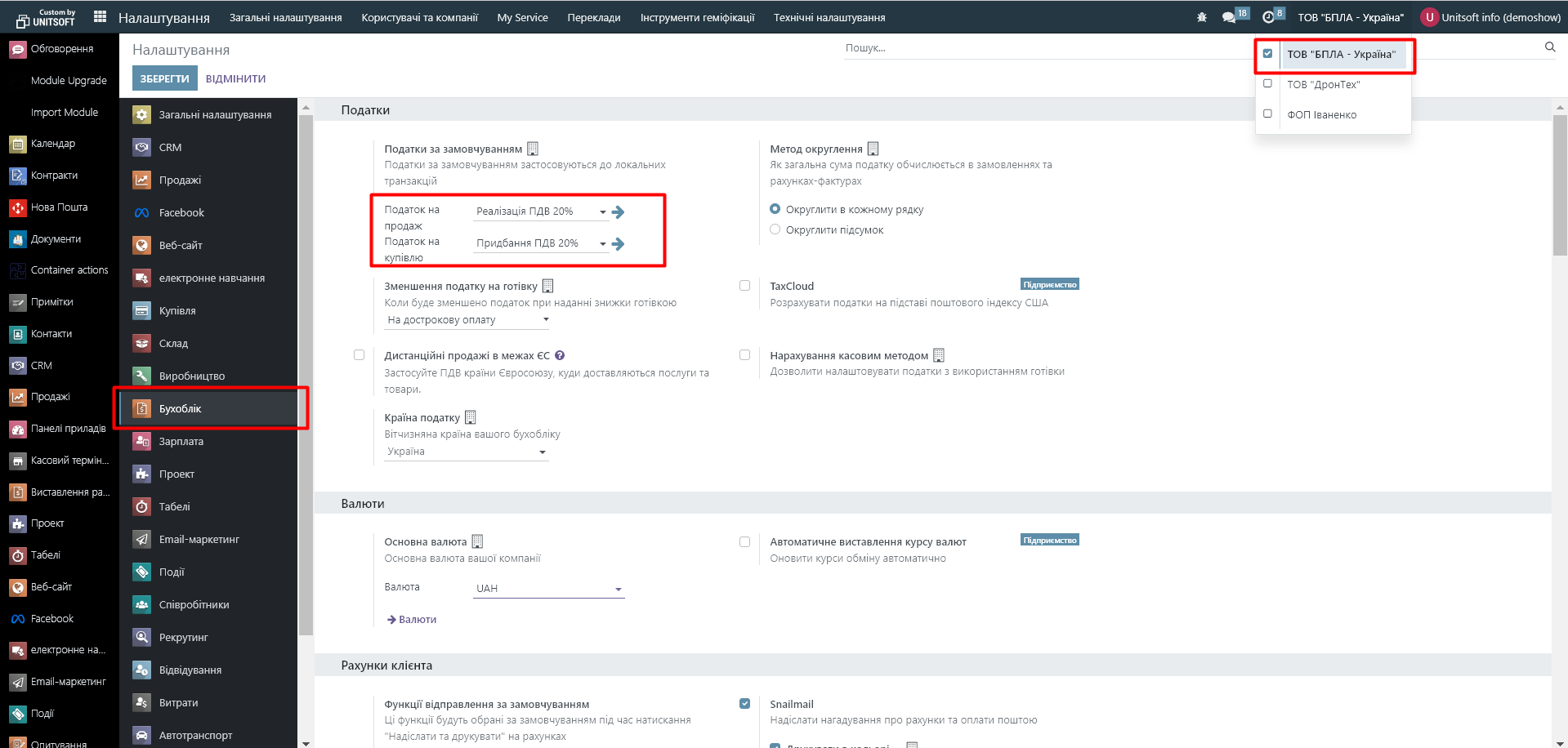

In addition, the settings automatically set default taxes for your company.

To view or change them, go to the "Settings" - "Accounting" - "Default Taxes" module:

These taxes will be automatically added to all products created in the database. Please note that this setting is valid within a specific company.

If necessary, you can set a default tax of 20% for one company, and remove taxes for another if it is not a VAT payer. To do this, simply switch the database to the desired company and then make settings for it.

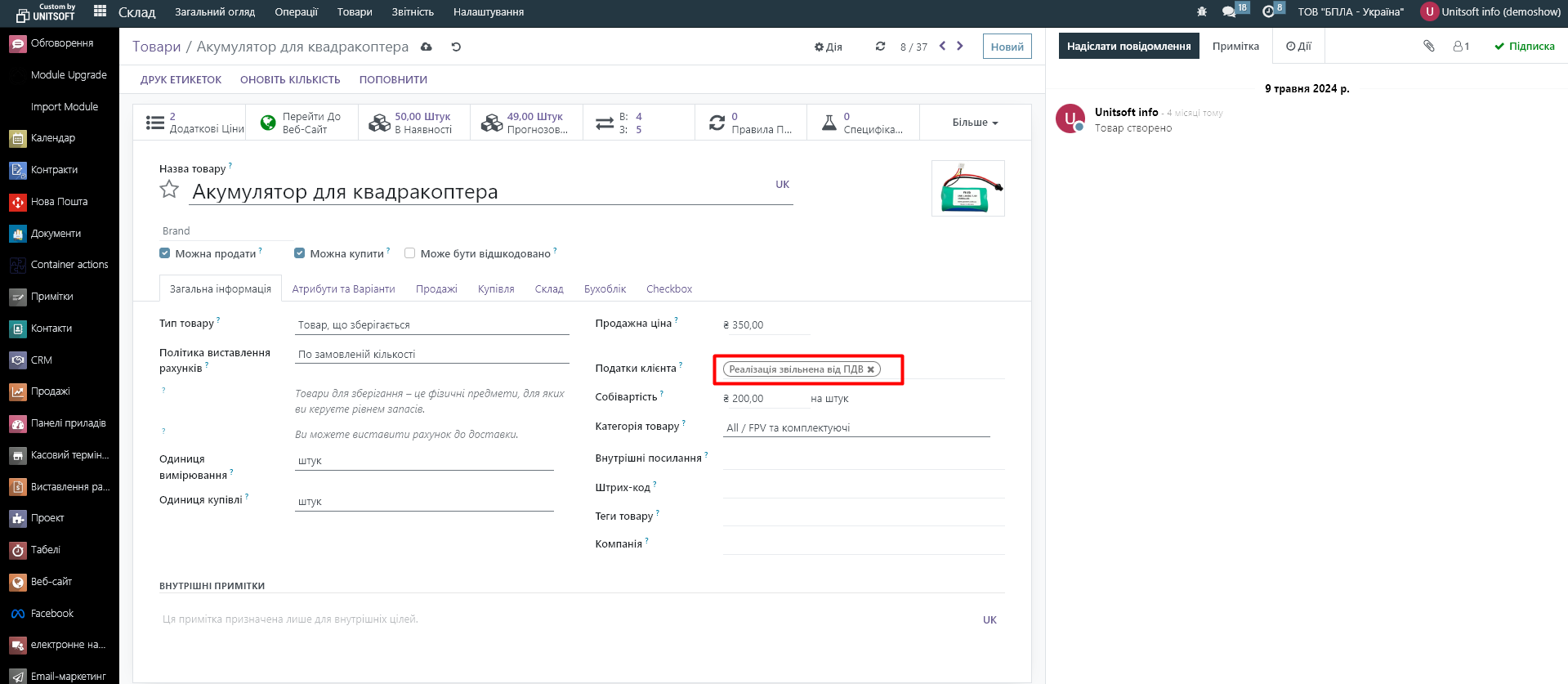

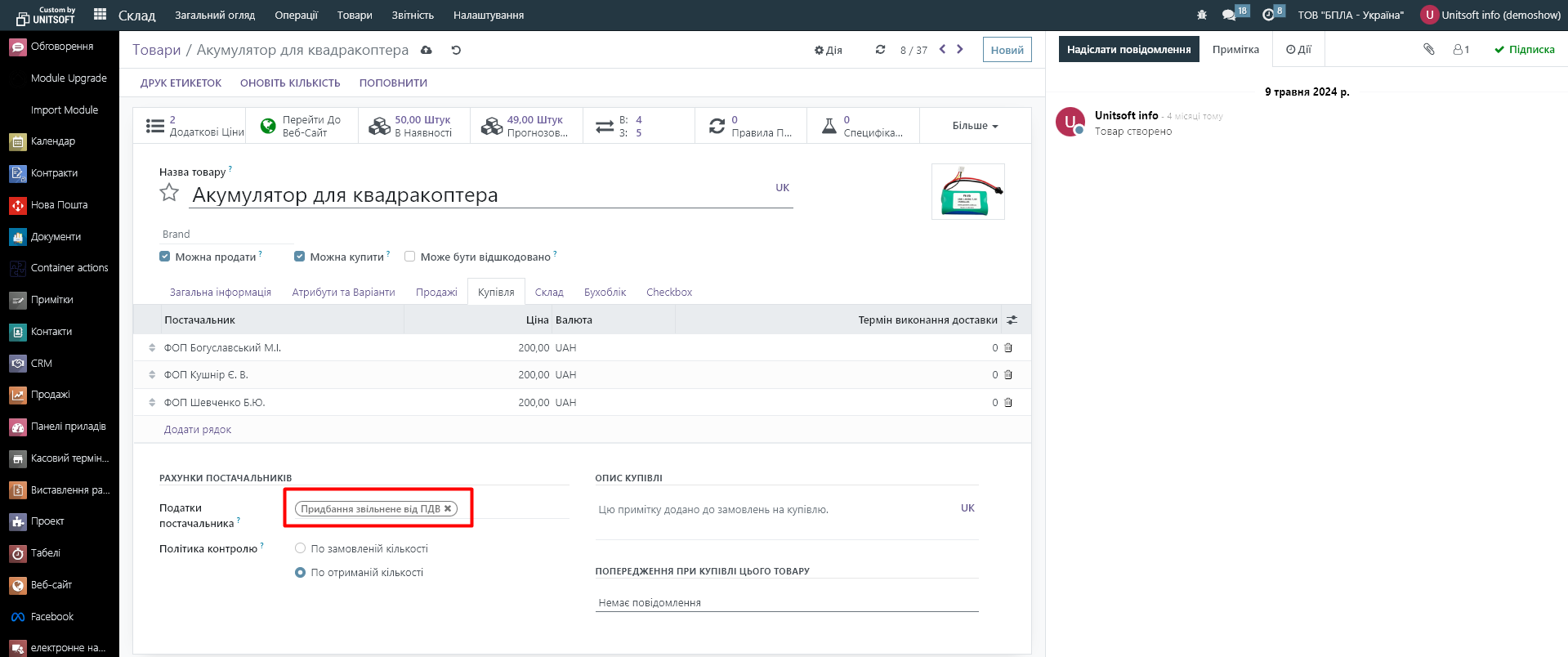

The next place where the tax rate is set is the product card. If the tax value that is set by default for a particular product does not suit you, you can edit (replace) it in the product card. Please note that the customer tax and supplier tax settings are set in different fields:

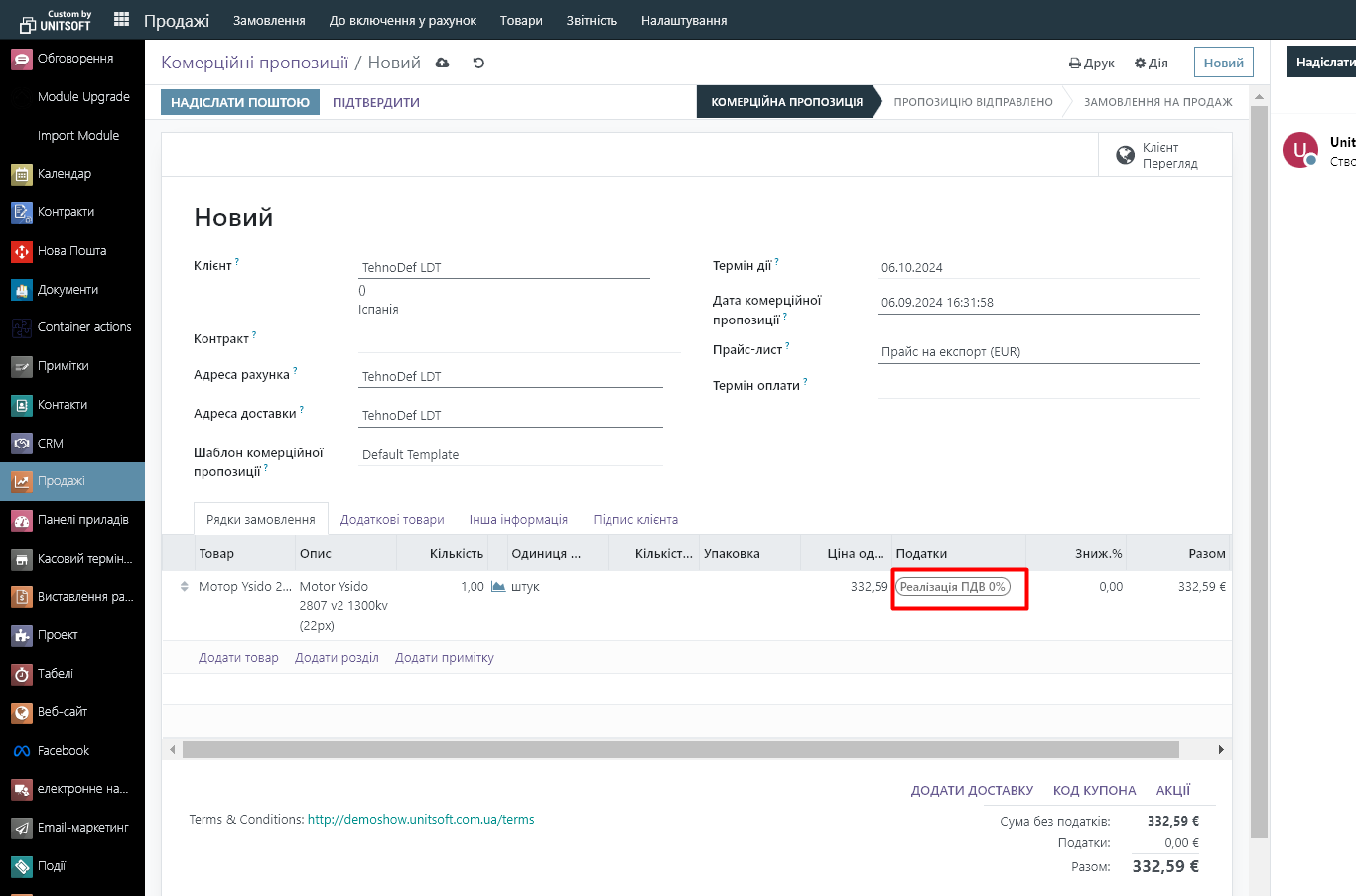

The last setting is when the VAT rate should change depending on the partner country. For example, the product "Ysido Motor" has a VAT rate of 20%, but for export sales it should change to 0%.

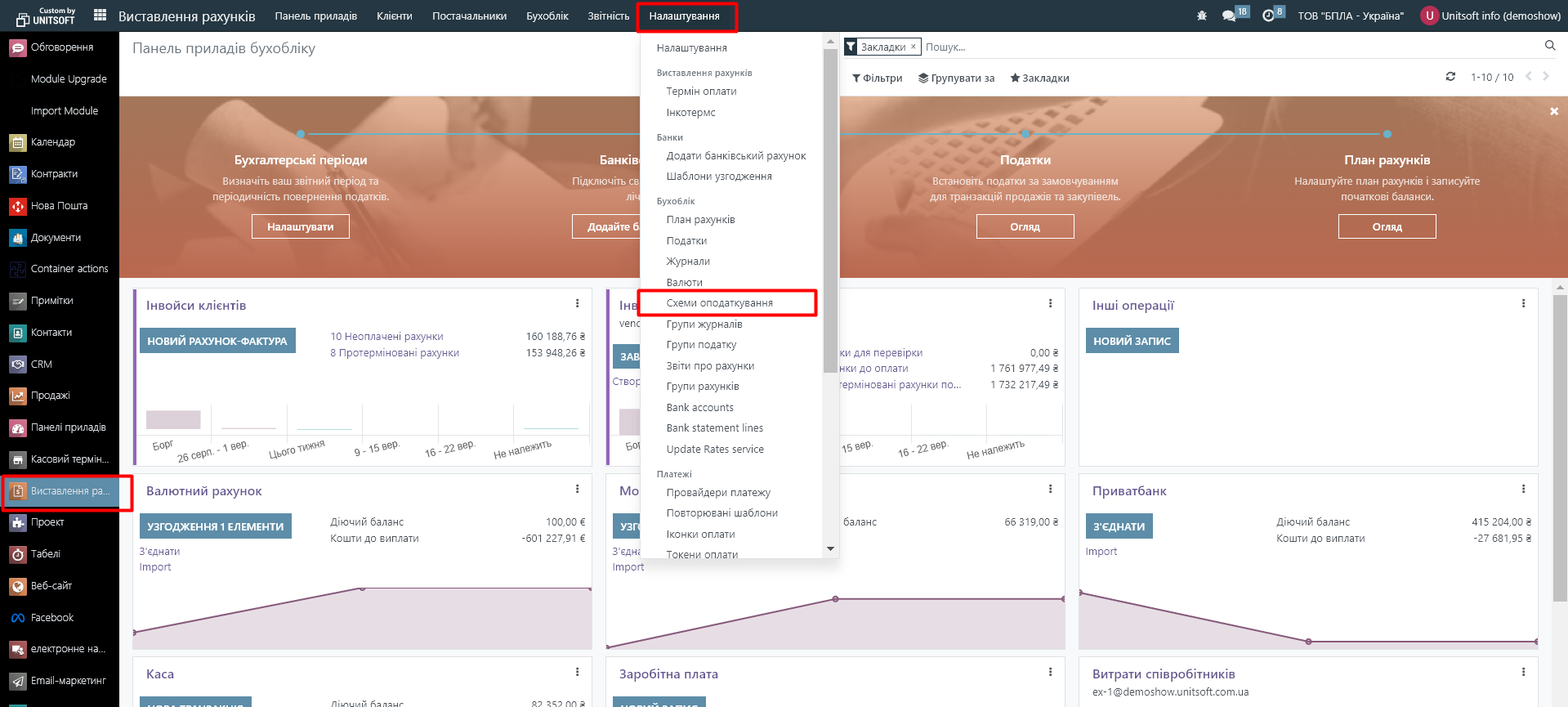

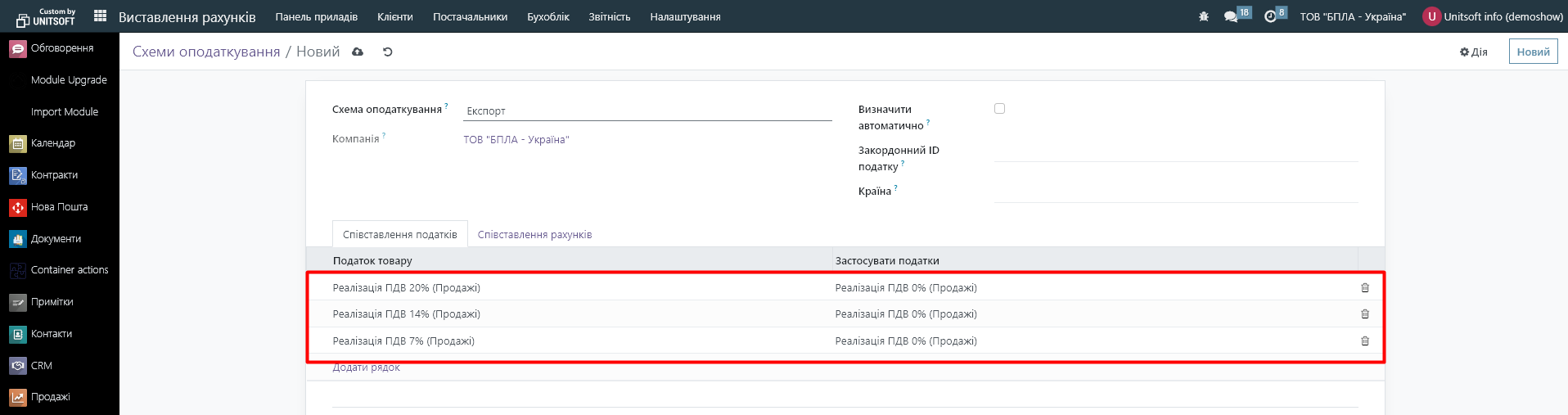

For such cases, you need to configure the "Taxation Scheme". To do this, go to the "Invoicing" module - "Settings" - "Taxation Schemes":

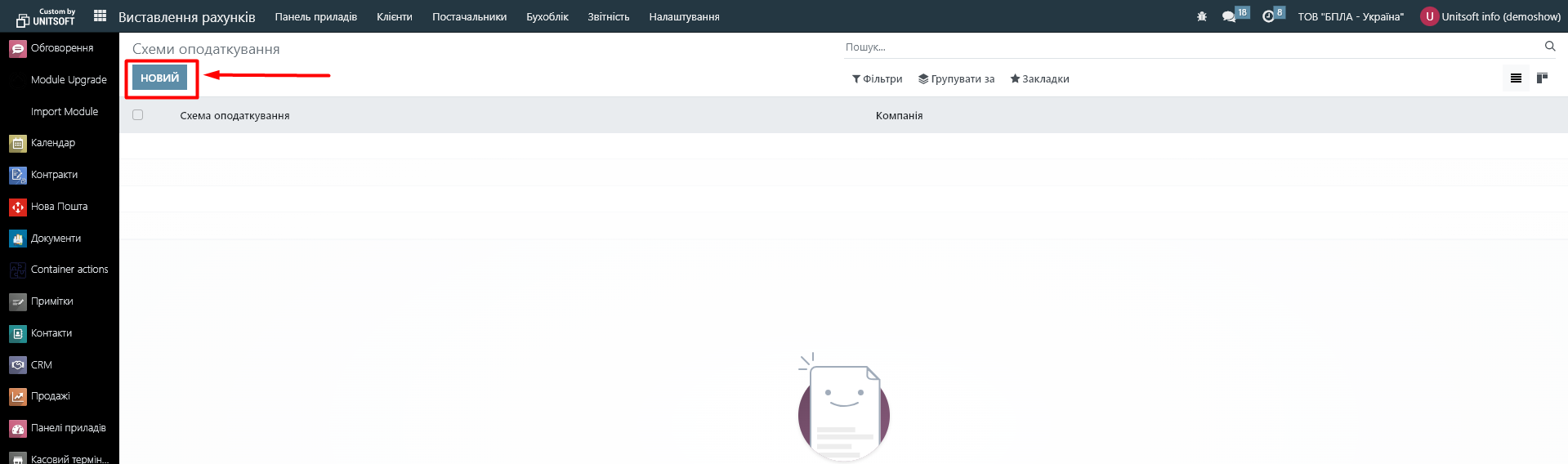

We create a new one:

We specify the name of the taxation scheme and specify the tax comparison. For example, if the VAT rate in the product card is 20%, then with this taxation scheme it should change to 0%. The VAT rate of 14% also changes to 0%, etc.

Saving the changes.

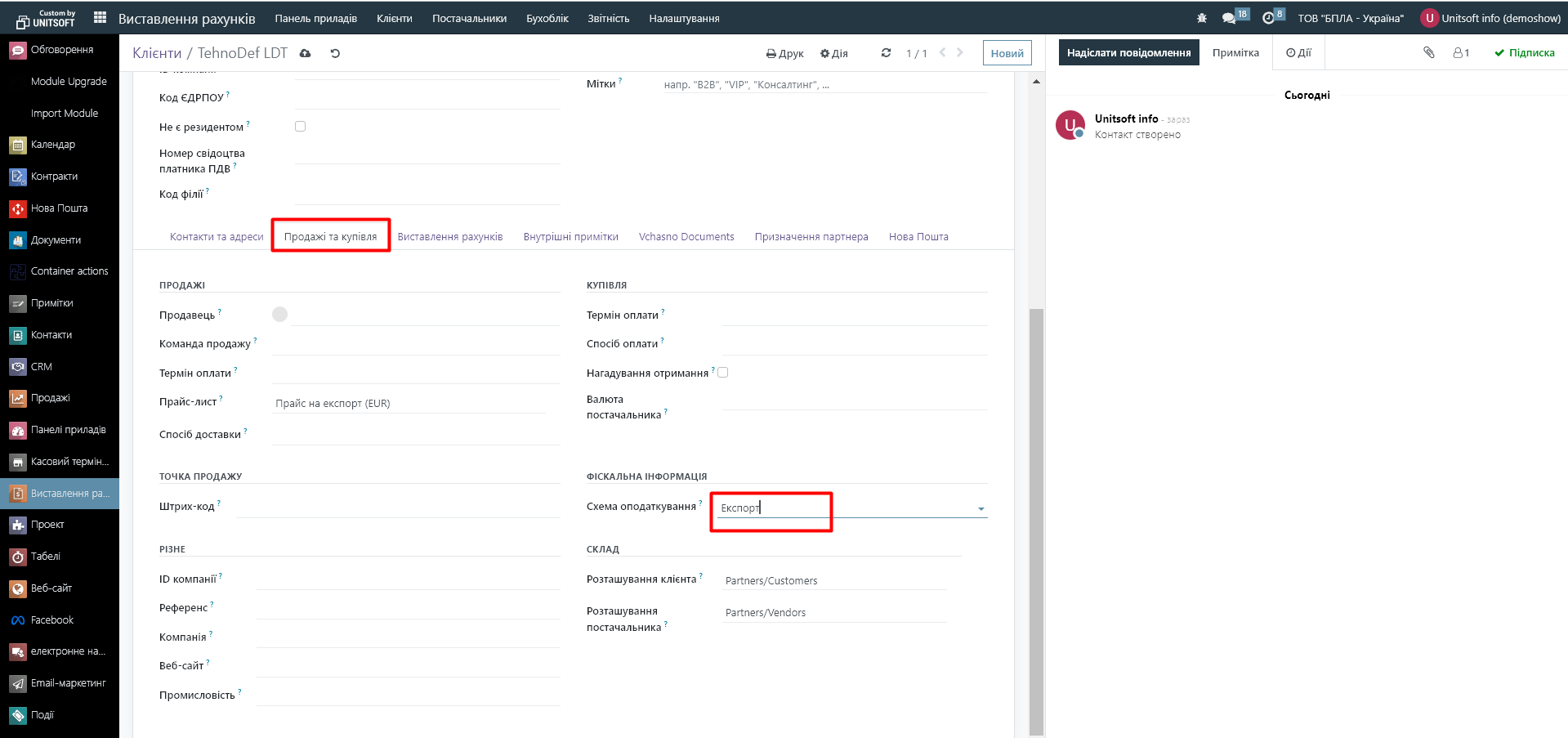

Next, in the partner's settings, we indicate that this taxation scheme applies to him:

As a result, when creating a sale for this partner, a 0% VAT rate will automatically be applied:

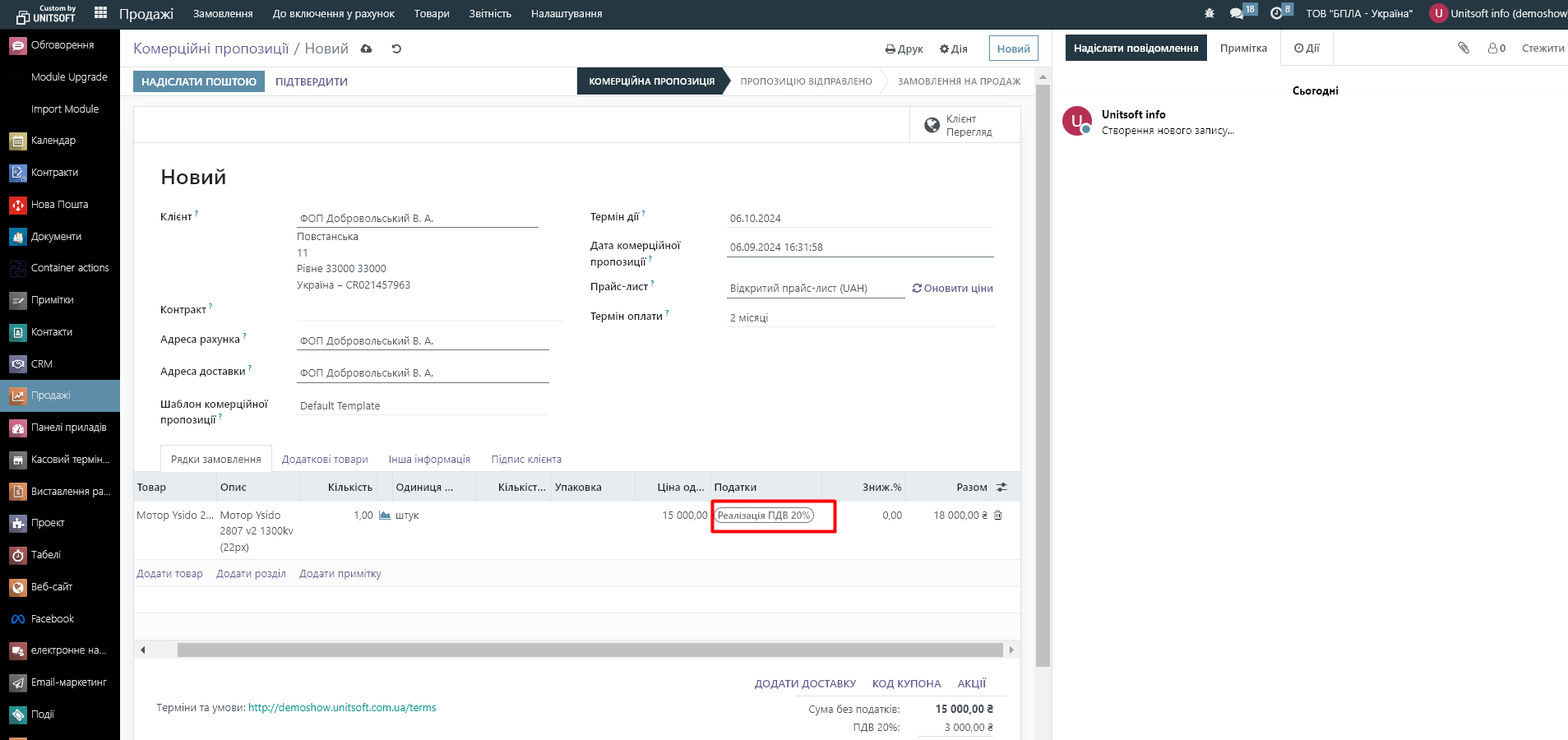

And for everyone else – the rate from the product card:

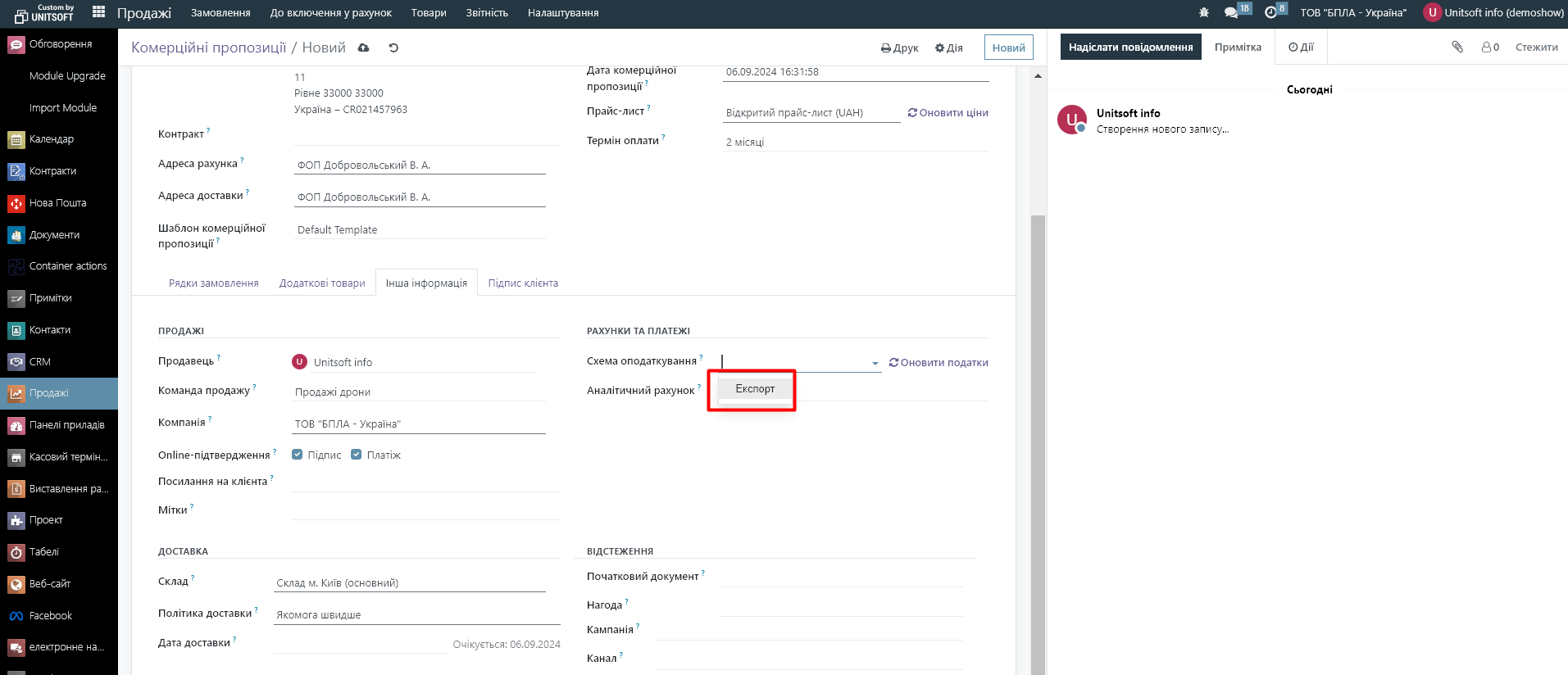

You can also specify the taxation scheme directly in orders: